The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 8, 2021

PRELIMINARY PROSPECTUS

Generation Asia I Acquisition Limited

$200,000,000

20,000,000

Units

Generation Asia I Acquisition Limited is a newly incorporated blank check company, incorporated as a Cayman Islands exempted company and

incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, which we refer to throughout this prospectus as our initial business

combination. We have not selected any specific business combination target and we have not, nor has anyone on our behalf, engaged in any substantive discussions, directly or indirectly, with any business combination target with respect to an initial

business combination with us. A significant number of our management and investment team, directors and advisors are located in or have significant ties to China or Hong Kong, and we may seek to acquire a company that is based in China or Hong Kong

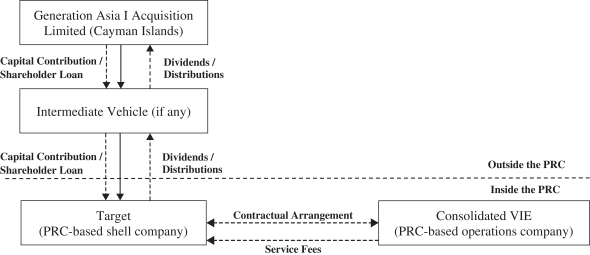

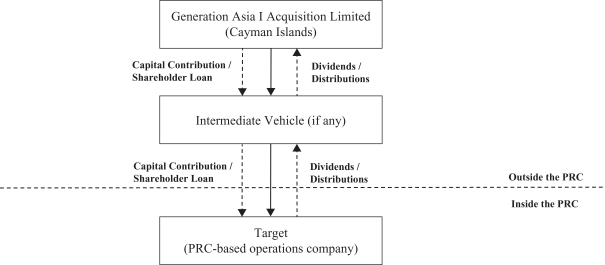

in an initial business combination. Because of such ties to China or Hong Kong, we may be subjected to the laws, rules and regulations of the People’s Republic of China (the “PRC”). There are uncertainties surrounding how such laws,

rules and regulations will be interpreted and enforced on us. The PRC government may also have significant authority to exert influence on the ability of us or a company we may acquire that is based in China or Hong Kong or has substantial

operations in China to conduct its business. These risks could result in a material change in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to

investors and cause such securities to significantly decline or be worthless. Particularly, recent statements and regulatory actions by the PRC government, such as those related to variable interest entities, data security or anti-monopoly concerns,

may have a negative impact on our ability to conduct business in China, accept foreign investments, or list on a U.S. or other foreign exchanges. Furthermore, if we enter into a business combination with a company based in China or Hong Kong, we or

such company may be subject to the PRC government’s regulations relating to foreign exchange, which may limit our ability to make loans to or inject capital into these subsidiaries, limit these subsidiaries’ ability to increase their

registered capital or distribute earnings to the company we entered into a business combination with or us, or may otherwise adversely affect us. We or the company we enter into a business combination with may rely on dividends and other

distributions on equity paid by our or its Chinese subsidiaries to fund any cash and financing requirements we or it may have.

This is

an initial public offering of our securities. Each unit has an offering price of $10.00 and consists of one Class A ordinary share and one-half of one redeemable warrant. Each whole warrant entitles the

holder thereof to purchase one Class A ordinary share at a price of $11.50 per share, subject to adjustment as described herein. Only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only

whole warrants will trade. The warrants will become exercisable on the later of 30 days after the completion of our initial business combination and twelve months from the closing of this offering, and will expire five years after the completion of

our initial business combination or earlier upon redemption or our liquidation, as described herein. We have also granted the underwriter a 45-day option from the date of this prospectus to purchase up to an

additional 3,000,000 units to cover over-allotments, if any.

We will provide our public shareholders with the opportunity to redeem all or

a portion of their Class A ordinary shares upon the completion of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account

described below calculated as of two business days prior to the consummation of our initial business combination, including interest earned on the funds held in the trust account and not previously released to us to pay our taxes, divided by the

number of then-outstanding Class A ordinary shares that were sold as part of the units in this offering, which we refer to herein collectively as our public shares, subject to the limitations and on the conditions described herein. If we have

not completed our initial business combination within 18 months from the closing of this offering (or (i) up to 24 months from the closing of this offering, if we extend the period of time to consummate a business combination subject to our

sponsor depositing additional funds into the trust account, (ii) up to 21 months from the closing of this offering, if we have entered into a definitive agreement during the first 18 months from the closing of this offering, without our sponsor

depositing additional funds into the trust account and, if needed, up to 24 months from the closing of this offering, subject to our sponsor depositing additional funds into the trust account, or (iii) during any shareholder approved extension

period, as described in more detail in this prospectus), we will redeem 100% of the public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account,

including interest earned on the funds held in the trust account (less taxes payable and up to $100,000 of interest income to pay dissolution expenses), divided by the number of then-outstanding public shares, subject to applicable law and certain

conditions as further described herein.

Our sponsor, Generation Asia LLC, has committed to purchase an aggregate of 6,800,000 warrants (or

7,700,000 warrants if the underwriter’s over-allotment option is exercised in full), each exercisable to purchase one Class A ordinary share at $11.50 per share, subject to adjustment as provided herein, at a price of $1.00 per warrant, or

$6,800,000 in the aggregate (or $7,700,000 if the underwriter’s over-allotment option is exercised in full), in a private placement that will close simultaneously with the closing of this offering. We refer to these warrants throughout this

prospectus as the private placement warrants.

Our initial shareholders, which include our sponsor, currently own an aggregate of 7,750,000

Class B ordinary shares (which we refer to as “founder shares” as further described herein), up to 750,000 of which may be surrendered to us for no consideration after the closing of this offering depending on the extent to which the

underwriter’s over-allotment option is exercised and including 2,000,000 Class B ordinary shares issued in connection with the forward purchase agreements described below. The Class B ordinary shares will automatically convert into

Class A ordinary shares concurrently with or immediately following the consummation of our initial business combination on a one-for-one basis, subject to the

adjustments described herein. Only holders of Class B ordinary shares will have the right to vote for the election of, and to remove, directors prior to or in connection with the completion of our initial business combination, which directors

will be proposed by the Company’s board of directors following a nomination by the nominating and corporate governance committee. On any other matters submitted to a vote of our shareholders, holders of the Class B ordinary shares and

holders of the Class A ordinary shares will vote together as a single class, except as required by law.

Funds managed by Carnegie Park

Capital LLC (which we refer to as “sponsor investor” as further described herein) have purchased membership interests in our sponsor entitling them to an economic interest in certain of the founder shares owned by our sponsor and in

certain of the placement units to be purchased by our sponsor. Pursuant to its subscription agreement with our sponsor, the sponsor investor will not be granted any material additional stockholder or other rights, and will only be issued membership

interests in our sponsor with no right to control our sponsor or vote or dispose of any founder shares, placement units or underlying securities owned by our sponsor (which will continue to be held by our sponsor until following our initial business

combination).

Certain qualified institutional buyers or institutional accredited investors who are not affiliated with our sponsor or any

member of our management, which we refer to collectively as the forward purchasers, entered into forward purchase agreements with us that provide for the purchase by the forward purchasers of an aggregate of 8,000,000 forward purchase units, with

each forward purchase unit consisting of one Class A ordinary share and one-quarter of one warrant to purchase one Class A ordinary share at $11.50 per share, for an aggregate purchase price of

$80,000,000, or $10.00 per unit, in a private placement to close concurrently with the closing of our initial business combination. The forward purchasers may purchase less than 8,000,000 forward purchase units in accordance with the terms of the

Forward Purchase Agreements. In addition, the forward purchasers’ commitment under the forward purchase agreements will be subject to their rights to terminate their commitment at any time before we enter into a definitive agreement regarding

our initial business combination. Accordingly, if any forward purchasers exercise their rights to terminate their commitment, such forward purchaser will not be obligated to purchase any forward purchase securities, and we will not receive any of

the amounts committed under such forward purchase agreement. We issued 2,000,000 additional Class B ordinary shares to our sponsor, which represents the adjustment to the ratio applicable to the conversion of its Class B ordinary shares

that our sponsor would have been entitled to at the closing of our initial business combination as a result of the issuance of 8,000,000 additional Class A ordinary shares under the forward purchase agreements. As a result, the issuance of the

Class A ordinary shares at the closing of our initial business combination will not trigger a further adjustment to this ratio. Further, prior to this offering, our sponsor transferred an aggregate of 1,200,000 Class B ordinary shares to

the forward purchasers for no cash consideration, which represent 17.14% of the Class B ordinary shares issued and outstanding immediately after this offering (assuming no exercise of the underwriter’s over-allotment option). As a result

of the foregoing, our sponsor currently owns 6,550,000 Class B ordinary shares, up to 750,000 of which will be surrendered to us by our sponsor for no consideration after the closing of this offering depending on the extent to which the

underwriter’s over-allotment option is exercised. The total number of Class B ordinary shares outstanding after this offering and the expiration of the underwriter’s over-allotment option, which includes the 2,000,000 Class B

ordinary shares issued in connection with the forward purchase agreements, will equal 20% of the sum of the total number of Class A ordinary shares and Class B ordinary shares outstanding at such time plus the 8,000,000 Class A

ordinary shares to be sold pursuant to the forward purchase agreements.

Certain qualified institutional buyers or institutional accredited

investors who are not affiliated with our sponsor or any member of our management, which we refer to as the anchor investors, have each expressed to us an interest to purchase up to 9.9%, 7.425% or 4.95%, or 1,980,000, 1,485,000 or 990,000 of the

units in this offering, respectively (excluding any units sold if the underwriter exercises the over-allotment option), representing in the aggregate up to approximately 101.475% or 20,295,000 of the units in this offering (or 88.24% of the units in

this offering if the underwriter exercises the over-allotment option in full), and we have agreed to direct the underwriter to sell to each of the anchor investors such number of units. For a discussion of certain additional arrangements with our

anchor investors, see “Summary—The Offering—Expressions of Interest.”

Currently, there is no public market for our

units, Class A ordinary shares or warrants. We intend to apply to list our units on The New York Stock Exchange, or NYSE, under the symbol “GAQ.U” on or promptly after the date of this prospectus. We cannot guarantee that our

securities will be approved for listing on NYSE.

We expect the Class A ordinary shares and warrants comprising the units to begin

separate trading on the 52nd day following the date of this prospectus (or the immediately following business day if such 52nd day is not a

business day) unless Nomura Securities International, Inc. informs us of its decision to allow earlier separate trading, subject to our satisfaction of certain conditions as described further herein. Once the securities comprising the units begin

separate trading, we expect that the Class A ordinary shares and warrants will be listed on NYSE under the symbols “GAQ” and “GAQWS”, respectively.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will

be subject to reduced public company reporting requirements. Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 51 for a discussion of information that should be

considered in connection with an investment in our securities. Investors will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings.

No offer or invitation to subscribe for securities may be made to the public in the Cayman Islands.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

| |

|

Per Unit |

|

|

Total |

|

| Public offering price |

|

$ |

10.00 |

|

|

$ |

200,000,000 |

|

| Underwriting discounts and

commissions(1)(2) |

|

$ |

0.55 |

|

|

$ |

11,000,000 |

|

| Proceeds, before expenses, to us |

|

$ |

9.45 |

|

|

$ |

189,000,000 |

|

| (1) |

$0.20 per unit is payable upon the closing of this offering. Includes $0.35 per unit, or $7,000,000 in the

aggregate (or up to $8,050,000 in the aggregate if the underwriter’s over-allotment option is exercised in full), payable to the underwriter for deferred underwriting commissions to be placed in a trust account located in the United States and

released to the underwriter only upon the completion of an initial business combination. See also “Underwriting” for a description of compensation payable to the underwriter. |

| (2) |

To the extent certain anchor investors purchase units for which they have indicated an interest in purchasing,

the underwriter will not receive any upfront underwriting discounts or commissions received from sales of securities to such anchor investors upon the closing of the offering, and the underwriter shall not be entitled to the deferred underwriting

commissions on gross proceeds received from the sales of securities to the sponsor, its controlled affiliates and the directors, officers, team members and investment entities of the sponsor and its controlled affiliates. |

Of the proceeds we receive from this offering and the sale of the private placement warrants described in this prospectus, $202,000,000, or

$232,300,000 if the underwriter’s over-allotment option is exercised in full ($10.10 per unit in either case), will be deposited into a trust account located in the United States with Continental Stock Transfer & Trust Company acting

as trustee, after deducting $2,020,000 in underwriting discounts and commissions payable upon the closing of this offering (or $2,620,000 if the underwriter’s over-allotment option is exercised in full) and an aggregate of $930,000 to pay fees

and expenses in connection with the closing of this offering and for working capital following the closing of this offering. Such proceeds will only be released from such trust account as described herein. The underwriter is offering the units for

sale on a firm commitment basis. The underwriter expects to deliver the units to the purchasers on or about , 2021.

Sole Book-Running Manager

, 2021